How To Calculate The Bid-Ask Spread

The bid-ask spread shows the relationship between buyers and sellers in a single transaction. It reveals “what and how” the buyer wants to buy; likewise, “what and how” the seller wants to sell. The bid-ask spread shows the two significant parts of a transaction: demand and supply.

The spread considers “how high demand” affects a trade and vice versa. Likewise, how high supply affects a trade, and vice versa. Understanding bid-ask spread gives a better space for smooth trading, especially as a stock market trader.

Bid-ask spread affects the stock market: it better explains your profit/loss expectation after a trade. Calculating the bid-ask spread shows potential profits & losses and the earning amount per share via the bid-ask spread. A better understanding of the bid-ask spread and its calculation gives you a relaxed mind for profits or a better preparation for loss.

For example, the stock market shows the historical price of a stock and not the current/asking price. You can decide to calculate the profit or loss via bid-ask spread without the historical stock price.

Any price you see on the stock market does not determine profit or loss; however, it gives an overview of the price expectation. For instance, company A sold a stock at $1000/share the previous time but increased the price to $1020 because of the high demand for the stock (bid).

Understanding the bid-ask spread is essential in this case because the initial price is $1000; however, the bidding is $1020. A trader who buys the shares, thinking he bought them at $1000, is at a loss of $20 on each share he purchases.

Bid-ask spread is a simple technique that prevents you from losing and earns you more profit. Learning and applying bid-ask spread in trading requires understanding bid & ask, demand, supply, liquidity, and spread. Learn more here.

What is bid and ask?

Bid and ask is the best potential price buyers and sellers agree to perform a transaction. Bid and ask is similar to what a layman calls a “bargain.” Bargaining in trade carries profits or losses at one (or both) ends. Assuming all factors remain the same – the investor profits from trade if he sells at the asking price: a buyer buys at the same price.

However, if all factors do not remain the same, an investor could sell at the asking price with a loss. The asking price reduces when there is a high supply with low demand: the same investor may sell the security at $100, assuming many suppliers sell at $100 (but low demand).

The bid price

For better understanding, assume “bid” represents a “buyer.” Thus, the bid price is “the value” a buyer is ready to purchase a security. A bid is more of buying and buyer. All individuals play a role in a trade: the buyers and sellers act concurrently in a transaction, and the action of one affects the other.

The ask price

For better understanding, assume “ask” represents a “seller.” Thus, the ask price is “the value” a seller is ready to sell a security. Ask price is more of selling and seller. As mentioned above, a buyer’s contribution to a trade determines the seller’s profit or loss. In addition, the market value determines the price at which a seller lists the security at a time.

For example, a seller may not sell because there is low demand/high supply – reduces the spread, and wait until the wider spread. Basically, learning about ask price, bid price, and spread saves you from loss.

The bid-ask spread

The spread is the difference between ask and bids prices: the relationship between how a seller and buyer agree to transact. Spread can be wide or narrow, which talks a lot about the transaction. For example, a high spread shows high liquidity, widely traded securities, and effective supply and demand.

Conversely, a low spread shows low liquidity, little traded securities, and unfavorable supply and demand. In short, the three factors (liquidity, security, and supply & demand) affect the spread. Here is how:

Understanding bid-ask spread and how to calculate

The bid-ask spread allows traders to conform to international changes and standards. Now, traders have a peak on the trade results, unlike when interpreting changing quotes. The spread is not apparent to novice traders (although skipping it may result in a loss); however, it is a viable tool in the hand of an active trader.

The little changes in bid-ask price (spread), like $0.5, may result in a great loss in the case of a large percentage of shares. The bid-ask cost should always be apparent to all traders, including a novice.

Widen spread occurs in an imbalance supply and demand: buyers may refuse to buy, and sellers may “hit the bid.” What happens during a wider spread affects both buyer and seller. As mentioned, sellers hit the bid (at high supply but low demand): a trader sells at the bid price. Conversely, the buyer buys at the ask price (low supply but high demand).

Supply and demand

Understanding supply and demand helps before exploring the spread further. Supply is the amount of security (assets) available for purchase in a marketplace. Note: the number of sellers affect the price and value diversion. Demand shows the amount of security (assets) buyers are willing to purchase in a marketplace. Demand works with willingness: the level of determination a buyer is willing to acquire an asset.

The bid-ask spread shows the “willingness to buy” and “availability for sales.” The spread measures the sellers’ and buyers’ input in a transaction, although the market influences these actions. For example, a market maker influences the market for self-gain. At this point, he leverages the “sellers and buyers” action to create an artificial “bid-ask spread” that works for his gain. Every market has a market maker, an important figure in understanding bid-ask spread.

As mentioned above, a narrow spread shows high liquidity and effective supply & demand, while a wide spread shows the opposite.

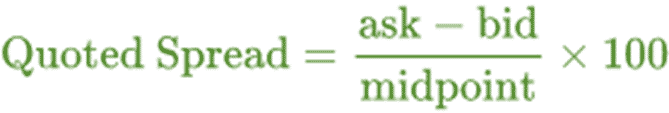

Calculating bid-ask spread

Bid-ask spread calculation differs based on the type of spread. There are three types of spread: quoted spread, effective spread, and realized spread. Quoted spread is the commonest among the three.

Calculating quoted spread

The quoted spread measures the lowest asking price and the highest bidding price.

Calculating effective spread

The effective spread measures the prices offered by a trader different from the quotes.

Calculating realized spread

The realized spread measures the real cost.

The importance of bid-ask spread

The market value and spread

The bid-ask spread allows you to understand what the market has for you. For example, it shows the parts and contributions of buyers and sellers in a market. It indicates if any (or both) should engage. You can figure the part of the trade that gains or loses according to the spread. For example, a narrow spread shows little difference between the bid and ask: both parties (buyer and seller) potentially profit if they transact. Conversely, a wider spread indicates a party that gains and other losses.

Liquidity and spread

The market value can be in the form of liquidity. Bid-ask spread shows the market liquidity if you buy security: liquidity is important to buyers and sellers; however, buyers take a large percentage. For example, how liquid an asset is, is the indicator of how a seller sells. But a buyer who buys less liquid security may suffer a loss because the value will be priced low. It is necessary to figure out the liquidity before you buy a stock.

More importantly, the bid-ask spread shows you exactly where you can check. One way to check liquidity from a bid-ask spread is the spread: if the spread is widened, try and understand the reason. Is it because of low liquidity?

Liquidity and market makers

Transaction facilitators improve market value; they are present in all markets. They are called market makers or specialists. The role of facilitators is to supply bid or offer when there is none. Bidding or offering may seize in a market because of price or value.

Facilitators influence the reasons people engage in trading, shift trading factors, and facilitate trades. A market maker can “make a market:” supplying both bid and offer simultaneously.

Market makers assume and influence price so that liquidity flows in the market. For example, assuming a trade has been going on at $30, the market maker can bid at $29.90 and offer $30.10 – that is, “calling the market.”

The market maker makes profits if he sells at $30,10 or buys at $29.9 – the market in turn changes from the initial $30 market value; Although this is unfair to the majority, this is how market space works. You will spot liquidity and price value differences quickly if you know the bid-ask spread perfectly.

Some bid-ask spread tips for trading

Take a risk with a limit order

Risk is a normal factor in trade: a reward is sweet, and risk may cause a lot of pain. Risk is not a new thing if you are used to trading. You can use limit or marker orders stop-loss in taking a risk.

A market order is a type of stop-loss. It is a stop-loss order at the current value (in price) when the security is sold out or when exchanges happen. Devaluation and increase in currency values affect the market orders. You may end a trade before it reaches the stop-loss if you predict a slippage or see it happening.

A limit order closes a trade at stop-loss when the amount (in price) equals the assigned stop-loss (value). Note that the market order stops at any price (once it reaches the stop-loss). However, a limit order stop-loss continues until the stop-loss has the same value (in price) as the stop-loss or even better. Limit order stop-loss is the preferred and most effective stop-loss in a bid-ask spread.

For example, suppose the market value for a security is $10.95 / $11; you could put a stop-loss at $10.97 – it assures you do not buy at $10. However, you may end the trade with a loss if slippage happens with an active market stop-loss order. Understanding risk and calculating it is a safe route out of loss in trading.

Prevent liquidity charges

A facilitator may work against you; however, you can prevent liquidity charges if you use a limit order stop-loss. In addition, limit order appreciates liquidity in your favor. For example, you may sell a security if the price appreciates (with a limit order) while it prevents you from buying at a price higher than your bid value.

Electronic communication networks (ECNs) facilitate slippage and use market liquidity. When this happens, limit order prevents you from losing, while market order may cause havoc. The spread enables effective stop-loss by showing how to place the stop-loss.

Access the spread percentage

You can check the spread percentage with the formulas listed above. The spread percentage shows each trade’s potential outcome (in multiple shares). In addition, it shows how risky the trade may be in the end. The spread percentage also shows when you can buy or sell and how much you generate if unforeseen circumstances (like slippage, low liquidity, fluctuating demand, and supply) occur.

Check around for the perfect trade

You do not have to make a trade happen by force. So, shop around and find the best offer if the odds are not perfect for you. Looking for a perfect trade is the best option for traders without “1-cent spreads,” especially in forex. Forex trading accumulates all the losses, which results in greater losses. Take your time; the perfect trade is out there. Find it!

More importantly, using a bid-ask spread allows you to locate the best trade considering all odds: positive and negative factors. Do not gamble, bid-ask spread shows you how to trade. The spread is important unless you are a novice trader; still, learning how to trade with a bid-ask spread is the best (even as a novice).

Read more: