How to Trade Bullish Engulfing Patterns for Maximum Profit

Bullish engulfing is a powerful candlestick pattern that can be used to predict future price movements. It is one of the reversal patterns with the highest degree of reliability, and when it appears, it almost always indicates that the downward tendency is about to end and the upward trend is about to begin.

This blog post will go over the bullish engulfing pattern, how to trade it, and different techniques that you may implement.

Bullish Engulfing Candle

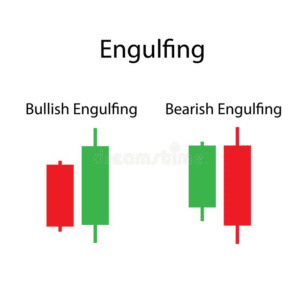

A Bullish Engulfing Candle is a candlestick pattern that foretells a reversal from a downtrend to an uptrend. It is composed of two candles, the first candle being smaller and bearish and the second candle being larger and bullish.

The bullish engulfing candle “engulfs” or “consumes” the prior small bearish candle. Bullish Engulfing candles are found at the bottom of downtrends, and their appearance signals a change in trend direction.

One of the most dependable and often used candlestick reversal patterns is known as the bullish engulfing candle. Bear in mind that the Bullish Engulfing Candle can only be valid if it forms towards the end of a downtrend. In addition, the Bearish Engulfing Candle must have a small real body with a long upper shadow.

The next candlestick should confirm the bullish engulfing by opening higher than the close of the previous bearish candle and closing higher than the high of the bullish engulfing candlestick. When these conditions are met, traders will look to enter long positions.

What Is Bullish Engulfing?

A candlestick pattern known as a bullish engulfing is created when a little black candlestick, which indicates a bearish trend, is followed the next day by a massive white candlestick. This creates a “bullish engulfing.” The body of the white candlestick should completely overlap or engulf the body of the black candlestick.

The pattern known as “bullish engulfing” is categorized as a reversal pattern, and its presence in the market is sometimes interpreted as an indication that bearish sentiment is going to give way to bullish sentiment.

Bullish engulfing patterns are most effective when there has been a large downward trend for a prolonged period of time.After a long downward trend, if you notice a bullish engulfing pattern, it would be a good idea to make a trade.

The Bullish Engulfing pattern is a classic technical analysis signal that can indicate the start of a sharp rally. In order to trade it effectively, there are a few key things you need to look for.

First, you want to see a strong momentum move coming into an area of support or resistance. This indicates that there is interest in the stock at these levels.

Second, you want to see a strong price rejection at these levels. This can take the shape of a long candlestick with a small body and a slender wick extending far into the distance.

Finally, you want to see volume confirm the move. This means that there should be heavy volume on the candlestick that forms the Bullish Engulfing pattern. If these conditions are met, then the Bullish Engulfing pattern can be a powerful signal for a sharp rally higher.

Bullish engulfing candlesticks are generally seen as a sign that buyers are in full control of the market, following a previous bearish run. The bullish candlestick is often seen as a signal to buy the market, known as going long to take advantage of the market reversal.

The bullish pattern is also generally seen as a sign for those in a short position to consider closing their trade. Bullish engulfing candlesticks can be found during both uptrends and downtrends, but they are most commonly associated with market reversals.

Bullish engulfing candlesticks form when the open and close of the current period are both higher than the corresponding open and close of the previous period.

Traders are able to confirm price reversals and make informed trading decisions with the help of bullish, engulfing candles, particularly when these candles are paired with other types of technical analysis.

Is Bullish Engulfing Reliable?

Bullish engulfing is a reliable indicator of a reversal in the market. This happens when the buyers are in control, and the price starts to move higher. The bullish engulfing pattern has high reliability, which makes it an excellent tool for traders.

It is critical to pay close attention to this pattern and use it to your advantage if you want to succeed. If you notice a pattern known as a bullish engulfing, you can anticipate that buyers will be in control of the market and that the price will continue to rise.

This presents a wonderful chance to increase one’s financial standing. Always be on the lookout for this pattern, and when you do spot it, make sure you capitalize on it.

Bullish Engulfing Scanner

The Bullish Engulfing Pattern Scanner scans for assets that have formed a bullish engulfing pattern. This powerful reversal pattern can be used to trade stocks at market bottoms.

The Bullish Engulfing Pattern Scanner is a valuable tool for any trader or investor who is looking to trade at market bottoms. With this scanner, you can easily find stocks that have formed this powerful reversal pattern.

What is a Bullish Engulfing Bar?

A bullish engulfing bar is a candle that signals a potential change in market direction from bearish to bullish. The formation of this type of candle typically occurs after an extended move down, which signals exhaustion among sellers.

When buyers begin to take an interest and push prices higher, it can indicate a shift in market sentiment. Bullish engulfing bars can be found on any time frame chart and can provide further confirmation for other bullish reversal signals such as ascending triangles and double bottoms.

They can assist traders in making more educated decisions about their trading strategy and confirm the strength of a prospective bullish trend when combined with other technical indicators.

Bearish Engulfing Candles

The bearish engulfing candle pattern is the inverse of the bullish engulfing candle pattern. It consists of a green candle that is entirely covered by the red candle that comes after it.

The formation of bearish engulfing candles indicates that buyers were in control of the market, whilst the second candle demonstrates that selling pressure drove the price of the market down.

The second period will begin with a higher price than the prior day but will end with a much lower price. Bearish engulfing candles are an important indicator for traders because they can signal a change in market direction.

When bearish engulfing candles form after an extended uptrend, it can be a sign that the trend is reversing and that a downward move is likely to follow. Bearish engulfing candles can also be used to confirm other reversal patterns, such as head and shoulders or double top patterns.

While bearish engulfing candles are not always accurate, they can provide traders with valuable information that can help them make better trading decisions.

Bearish engulfing candlesticks are important signals for traders that the market is about to enter a downtrend. The pattern is formed when a bearish candlestick, which has a lower close than the previous candlestick, completely engulfs the previous candlestick’s body.

This is a signal that bears have taken over the market and are likely to push prices down further. The bearish engulfing pattern is often seen as a sign to enter a short position or to short-sell the market.

When trading using this pattern, there are a few limitations that you should keep in mind. First, the signals are most useful following a clean upward price move. If the price action is choppy, the significance of the engulfing pattern is diminished.

Second, the size of the second candle can also be extremely large, which means that a trader who follows the pattern could end up with a very significant stop loss if they choose to do so.

It’s possible that the potential gain from the deal won’t be enough to justify taking the risk. When trading the bearish engulfing pattern, it is crucial to be aware of these limitations because of the implications they have.

Because of this, it is essential for traders to be aware of this signal and understand how to interpret it when it appears appropriately.

Differences Between a Bullish Engulfing Pattern and a Bearish Engulfing Pattern

A bullish engulfing pattern is the opposite of a bearish engulfing pattern, which implies that prices will continue to decline in the future. There is a two-candle design, and the first candle in the pattern is an up candle. The second candle is a larger down candle, and it has a real body that completely encapsulates the already mentioned candle.

Bullish and bearish engulfing patterns are powerful signals that can help traders determine when to enter or exit a trade. These patterns often occur at market turning points and can be used in conjunction with other technical indicators to confirm a trade setup.

While bullish and bearish engulfing patterns can be useful for identifying potential reversals, it is important to note that not all engulfing patterns will lead to a reversal. Sometimes, these patterns can simply be part of a consolidation phase before the trend resumes in the same direction.

As with any trading strategy, it is important to use caution and employ sound risk management when trading reversals.

Why are Engulfing Candles Important?

Engulfing candles are important for traders because they can assist in spotting reversals, indicate a strengthening trend, and provide an exit signal. Engulfing candles can be used to spot reversals because they indicate a change in momentum from bearish to bullish or vice versa.

In addition, engulfing candles can indicate a strengthening trend because they show that the market is moving in one direction with increasing momentum. Finally, engulfing candles can provide an exit signal for traders who are holding a position in an existing trend that is coming to an end.

If a trader sees a bearish engulfing pattern during an uptrend, it is a signal that the trend is coming to an end, and the trader should exit their position. Engulfing candles is an important tool for traders because it can provide valuable information about the market.

When it comes to trend trading, the engulfing candle is a valuable tool. This candle pattern can provide traders with information about the current trend’s strength and the likelihood of continued momentum.

While the engulfing candle is often found at the end of a trend, it can also appear within a strong trend, pointing to continued movement in the same direction. When using this pattern to trade, it is important to consider the context in which it appears and to combine it with other technical indicators for confirmation.

When used correctly, the engulfing candle can help traders make more informed decisions about their trades and potentially improve their results.

How to Trade Bullish Engulfing Patterns

The first step in trading bullish engulfing patterns is to identify the pattern. The bullish engulfing pattern consists of two candlesticks. The first candle is typically a small bearish candle, and the second candle is a large bullish candle that completely engulfs the first candle.

The key thing to look for when identifying this pattern is the change in momentum from bearish to bullish. This is indicated by the large difference in the size of the two candlesticks.

The next step is to wait for confirmation before entering a trade. One popular way to confirm the engulfing pattern is with the MACD indicator. The MACD indicator consists of two moving averages that measure the market’s momentum. When the MACD line crosses above the signal line, it is a bullish signal, and when it crosses below the signal line, it is a bearish signal.

The MACD can be used to confirm the engulfing pattern by providing confirmation that the change in momentum from bearish to bullish is indeed taking place.

Once the MACD gives a bullish signal, traders can enter a long position at the market opening of the next candlestick. The stop-loss should be placed below the low of the engulfing candle pattern.

The target profit can be set at a previous resistance level or a 1:1 risk-to-reward ratio. For example, if the stop-loss is placed 20 pips below the entry point, the target profit should be 20 pips above the entry point.

Following these simple steps, traders can trade the bullish engulfing pattern more successfully.

Conclusion

Bullish Engulfing candles are important because they can be used as a signal that security is about to change trends. When you see a bullish engulfing candle, it means that the bulls have taken control of the bears. The next step is to find out where the security is headed and trade accordingly. We hope this article has helped you learn more about bullish engulfing candles and their importance in trading.