What Is The Smart Money, And How Does It Determine Profits?

Understanding Smart Money

Smart money is also the force that controls markets. The central banks and other institutional investors initiate the force. For example, an ordinary investor cannot control the market: the main controllers are the “big boys” in the market – these big bodies are referred to as financial professionals. In order words, the moves and trades are not hidden from some selected people in the market: some bodies know how the market will behave in a couple of days, weeks, or months, and these people are referred to as financial professionals.

Any investment by financial professionals (in this context) is called smart money. Smart money is referred to as such because of the underlying factors. For better understanding, we shall divide investors into two groups: retail and financial-professional investors. Financial-professional investors have the knowledge, valid sources, and data for trades in the future.

On the other hand, a typical retail investor trades based on assumptions and validation from research and trading experience. A retail trader cannot influence the market; he can only make a profit or loss. However, financial-professional investors influence the market and control the market for profits.

Another essential fact of financial-professional investors is making the profit work for themselves. Whoever (any trader) trades using or following the concept of the financial-professional investors makes money simultaneously with the professionals. All the concepts of the professionals may not always be true. However, it is common that their trade leads to profits.

In another case, consider smart money as a gambling setting. Assuming an individual A has all the knowledge about a card game and plays against 105 people (who are neutral). They are neutral because they don’t have the knowledge individual A possesses. The knowledge is insider information, the type, and the game secret. Individual A will likely make much profit if he applies all he knows and the information given to him.

Individual A is the same as a financial-professional investor in the case of smart money: the financial-professional investors have access to classified information hidden from the public. No one among the 105 people will suspect individual A. The reason is that non among the 105 know one another. The market is saturated with independent, neutral, and free individuals who trade without depending on anyone or separate information. However, the smart money is different. Smart money is the capital that financial-professional investors control. Unlike neutral money, these are special. How? Here is how and why:

Identifying Smart Money

Volume And Smart Money

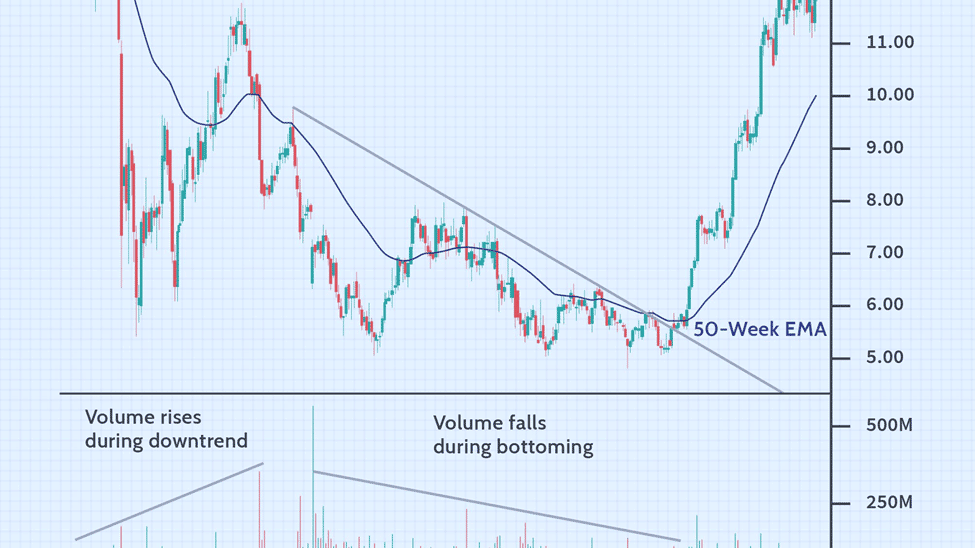

Believe it or not, the volume is among the useful indicator of smart money: when the volume changes, it may indicate the presence or absence of smart money. For example, a financial institution’s investment is always higher than a typical retail investor’s. In another case, all financial investors do not engage in trade often; they come once in a while and move the market. So, the higher their impact on the market, the higher the market volume.

You might quickly note the presence of smart money if you notice and could figure out “what causes the change in the market volume” at a specific time. Again, the smart money is a normal movement in the eye of all traders. However, it moves more profits to a side of in market: you might make more money than usual if you follow the trend. Notwithstanding, identifying the presence of smart money in the market is challenging – this is why volume is essential!

Volume is essentially important in figuring out critical points: the points at which the market makes changes. Volume analysis shows the patterns of price dynamics and their peculiarities which are invisible to the naked eye. The naked eye cannot see the wonders of smart money. However, focusing on volume analysis, using the power of this indicator, can hint you to locate the direction of smart money in a trade.

Another important factor in identifying smart money is understanding activity levels in a trade. The level a trade occurs is important in determining the next events. Although smart money is sure, it is not always certain – the fact that smart money is not always certain shows that every factor in trading works on probability. How you can make your probability, a sure factor depends on you.

The trading level may be high or low at a time. What causes the trade to be so active or inactive? What makes the market volume rises or low? And how fast do people sell or buy? These are questions a typical volume analysis answers. In addition, volume analysis can show active or inactive smart money. As mentioned earlier, the more financial institutions come into a trade, the higher the trade volume – the higher the volume, the higher the chance of locating forces affecting the trade.

A financial institution with better data invests according to the data, irrespective of the current market trend. Remember that financial investors change the market game. Volume analysis shows the point when the market changes – although the reason may not be apparent, at least you can pinpoint some changes that deviate the market from the initial trend.

Combining stock charts, volume analysis, and price action gives an understanding of a market’s active or inactive smart money.

Lastly, smart money actions have always tried to legally conceal their movement from the public. They can achieve this since everyone is independent of the other, and the market is accessible from anywhere in the world. However, they cannot conceal the market volume from the public – it is always apparent.

Traders do not always prioritize volume analysis, although the volume always shows significant smart money actions. The strategy is to “follow the smart money.” To do this, you will need a lot of studies/links as smart money moves are hidden from the public.

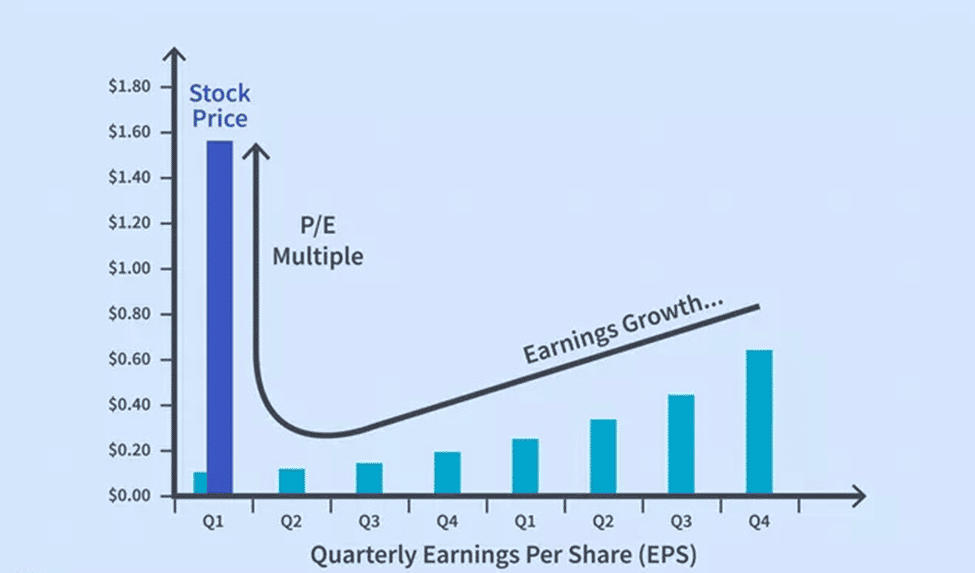

Stock Pricing And Index Options

Index options and stock pricing are other ways to find and follow smart money. More informed bodies in the trading world know more about smart money. “The strategy is to follow the smart money:” you can do this by following well-informed bodies. They know what you do not know; if you follow them, you will know more about things you cannot figure out yourself.

Index options are like a chain that connects the lowest to the next in rank, and the chain continues. You may not quickly locate the smart money actions since you are not well informed. However, this may be untrue if you know a few updates about smart money. You may link up with the bodies that know more about the trading moves if you cannot perform the basic analysis (like volume analysis) to pinpoint smart money – this is where index options and stock pricing come in.

An index option is a subordinate monetary agreement whose worth is gotten from a fundamental securities exchange list. It gives the holder the right (however, not the commitment) to trade the basic file at a predefined strike cost. Record choices include call and put options that allow the holder to trade individually. The underlying list can be a wide-based file like the S&P 500 Index, or sector-based, for example, the TSX Composite Bank Index.

Data Sources And Methods

Using data sources and methods, you can group traders into informed and non-informed traders, commercial and non-commercial trading activities.

According to Poisson-independent distribution, non-informed traders trade based on reasons and factors best known to them and not according to the model. However, informed traders trade based on information unrevealing to the public; thus, they have a high probability of making profits from their trades.

In this case, uninformed traders have little or no connection to tracking the activities of smart money. However, informed traders may know direct sources or links to get information from smart money. Individuals who change the channel of collecting information, especially “how and where to trade,” from mere calculation to a direct source and links may increase the change of making profits by “following the smart money.” “Information is powerful,” they say. However, information makes profits in trading. You can change your trading game if you access the right information.

Data sources and methods are important in trading (not only in smart money) because they are for future use. “Future, time, and how” are the three factors embedded in data sources and methods. The future is not now, so any data source and methods do not push you to make a move; it instead gives an update on the future. For example, the information may predict certain market changes and give you the direction of investment (the how) when the changes occur.

The change in market movement might be attributed to smart money moves. So, if you follow smart money (making a move when you notice the changes), you create a better option for profits. Smart money can influence the market; it can control the market and undo and do things for profits. However, they perform all these by limiting the exposure to the public. Notwithstanding, some individuals always know the smart money moves. Such is referred to as reliable sources. Lastly, finding reliable data sources and methods gives you a high chance of “following the smart money.”

What Is Smart Money Trading?

If you use the institutional trading strategies to make a profit – then you practice smart money trading. It is as simple as that – however, we should mention retail trading strategies when considering institutional trading strategies.

Let’s say the retail trading strategies are the data and techniques a first-year university student uses to solve a math problem in a math quiz. At the same time, an active mathematics professor uses the institutional trading strategy to solve the same problem. The problem is trading, the method is trading strategy, and the bodies involved are first-year students and mathematics professors.

Who among the two has a higher chance of winning the quiz? Obviously, the active mathematics professor. The same thing applies to trading: no matter how much the first-year student absorbs in mathematics, the professor has superior knowledge in the field.

The retail trading strategy is the first-year student, and the institutional trading strategy is the professor. As much as the retail trading strategies try, they cannot be more powerful and accurate than the institutional trading strategies. Sometimes, the retail waits for the institutional signal before it trades. The retail trader figures out the methods that might work; however, the institutional traders (most times) know the methods that work.

Smart money trading is simple: finding smart money and following the trend. It is not always certain and true that you will make profits once you know and follow the smart money. However, it is better than retail trading strategies in most cases. What is being insinuated is to trade with all caution even if you follow the smart money.

Some individuals are considered smart money investors, for example, Warren Buffett. However, the scale of investment is not always considered. When Buffet seized from investing, some retail investments following his moves may stop investing and observed his next moves. In short, they follow smart moves. The reason Buffett refused to invest may not be a tangible fact; he might just be observing the market. Thus, those who wait for his super action may profit when he makes moves.

Read more:

Subtitle TOC

Table Of content

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris tempus nisl vitae magna pulvinar laoreet. Nullam erat ipsum, mattis nec mollis ac, accumsan a enim. Nunc at euismod arcu. Aliquam ullamcorper eros justo, vel mollis neque facilisis vel.