Paper Trading: Trading with Confidence

Paper trading existed as far as the paper age: when computers were not used in trading but paper. Paper was the only options stock market traders used to predict and practice trading; thus, “paper trading.” You have applied the concept of paper trading in “demo trading” in Forex and another virtual trading related to similar trading platforms. Simply put, you practice paper trading, provided you don’t trade with a real account (with real money).

There are many advantages and realistic expectations of paper trading, especially for new traders. Are you a novice trader looking for a better way to establish your knowledge before applying your ideas in a real account? Then, paper trading is a must for you. Learn more below.

Table of Content

What is paper trading?

Forex traders call it “demo trading:” a demo practice before a real account. Paper trading is a long-term expression that explains a trade without real money. Every trader learns the concept of trading but never risks their money, at least not until they have the confidence to make real money. Life requires practice: our mothers taught us how to walk, speak, and do many things as a baby. The same applies to paper trading: it teaches novice (babies) how to “walk and speak” trading – thus, you can call paper trading “the mother” while the novice traders “the babies.”

Paper trading is as simple as saying “trading without real money.” Although the paper trade’s advantages outweigh other practices employed in trading (as a novice), you need to learn more before you explore further. Obviously, paper trading existed before the computer age. Paper trading was modified into the modern world as “demo trading,” among other terms used in describing the concept. It has continued to grow since the beginning of trade technology and modern evolution. For example, all brokers provide a “paper trading concept” for newbies in any trading platform. Although computers and the internet are the modes of application; still, they practice paper trading. Getting familiar with paper trading is necessary since the concept is inevitable in trading and mastering trading without losing money.

Do you have an idea? Paper trading test new ideas before a live account. This is not the only advantage of paper trading. As much as paper trading is inevitable for everyone wishing to learn to trade, there are some cons to paper trading. Before we consider the pros and cons of paper trading, let us talk about the relationship between paper trade accounts and live accounts.

Relationship between paper trade accounts and live accounts

Paper trading gives the sense of “free will” trading. However, these free habits do not work in the real account. There are risks, seriousness, and proper monitoring in live accounts; however, traders lose this sensation because of the false realities in paper trade accounts. You would use a paper trade account excellently if you could bring the three sensations (risk assumption, seriousness, and proper monitoring) into practice.

Paper trade accounts, unlike live accounts, allow basic trading ideas. For example, traders buy low and sell high in paper trade – this idea is challenging in a real account; however, traders practice it with total ease in a paper trade account. Staying above the risk of paper trading is the same as mastering the cons of paper trading: buying low and selling high is one of them. Follow the trend, learn the market, and figure out the next account according to the current market trend – do not develop an idea of “buy low and sell high” with your demo account. You don’t have to “buy low and sell high,” even if it is easy with a paper trade account. Instead, master the right things by assuming you trade with a live account.

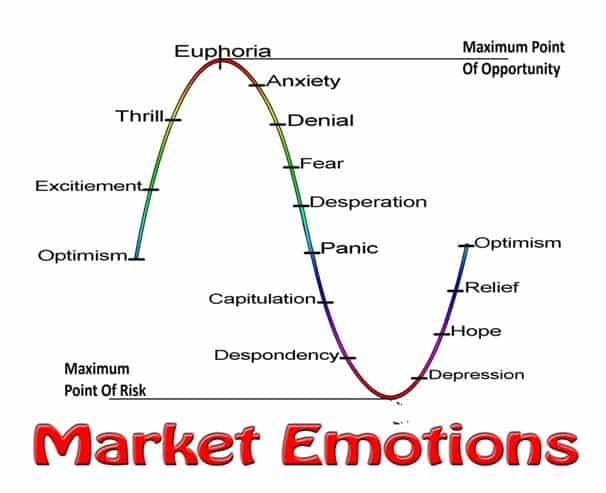

Human physiological behaviors change during a realistic event: this applies to paper trading accounts vs. live accounts. In paper trading accounts, traders and investors maintain stable emotional flows: they are well organized during the trade. However, the situation changes when real money is at risk. How well can you manage stress in a real event? Emotion balance and stable organization before a live account trading are the best. Build your emotional capacity while learning how to trade: you will be ready for a live account.

Several factors are associated with live accounts absent in demo accounts and vice versa. It would be best to figure out these factors and work on them individually—for example, the “greedy attitude” in a demo account. Greediness blinds our eyes – we fail to see the reality, especially when closing a trade. Learn and do not gamble! Paper trading increases greediness and reduces learning attitudes. Learn each step, ideas, and ways to overcome certain trading situations – test-run some ideas instead of fighting to acquire more. Lastly, do not remind yourself that “this is a demo account;” take it as a live account instead.

Ways to paper trade

The illustration above talks about the negative impacts of paper trading on a novice. It would help if you learned how to paper trade since you learned the negativity of paper trading.

a. Explore the market before practicing

Paper trading without a guide affects the newest traders. Do not rush; instead, learn the ways and best approaching procedures. You have a long time of practice, so do not rush. Explore the market: take your time and get an idea you would emulate from a market personality. If you create a goal (aside from learning trading via paper trading), you will have a better reason not to gamble or be greedy while you learn. Also, exploring the market before practice reduces emotional stress when you trade with a live account, especially if you encounter the same challenge you overcame on a demo account. You can get market ideas from websites, an expert’s analysis, tutorials, and videos.

b. Learn the basics of market trading instead of acquiring profits

Profit is good; however, the basis of buying and selling determines if you will keep the profits. Learn trading opening: how can you open a market without losing your assets? Learn about tickers during the trading day and how to pick a good entry spot.

c. Use your pen and book

Cognitive learning is good; however, learning more with pen and book creates a better way to keep profits. Keep your books nearby when you practice; you will likely come across some difficulties, write them down and practice how to overcome them. Overcoming emotional stress via physical assets is effective compared to other practices: your mind will quickly be at rest if you have a book containing solutions to trading problems.

d. Repeat until you can analyze the process

Keep practicing the process until you can teach others. “Practicing to participate” is different from “practicing for mastering.” If you must master an approach, you should be able to teach others. Learning for mastering means you can spot differences, analyze difficulties, and solve problems. Repetition increases mastering: it comes by emulating experts. Some useful things you learn from paper trading are stop placement, holding period, volume, sector, and time of the day.

Pros of paper trading

As mentioned earlier, there are many advantages of paper trading. However, it is best to learn paper trading using the “safe practice procedures” mentioned above.

Zero risk

Paper trading allows you to learn the basics of trading without real money risk. However, do not consider this while you trade; picture it as a live account. You master your flaws without losing money – this is the best for novice traders. Ensure you practice as much as you can since zero risk is involved.

Zero stress

There is no emotional stress in demo trading. It will help if you create a realistic feeling using the demo account. Yes! You won’t be shocked if you lose all money in your demo account; however, learn to create a realistic environment. Since no stress is involved, you should explore the paper trade account to the maximum level. Try as much to know all the crucial things about trading from the demo account; it is more appreciating if you can learn beyond the normal level before you practice with a live account.

Preparation by practice

Practice prepares you for favorable and unfavorable situations. How do you feel when you make a profit or loss – this is an important behavior worth studying. You can put yourself under control when you know how you behave in uncommon situations. For example, your behavior during a profitable trade is important because it may affect you, assuming you overreact. If you fall under this category, you should work on keeping the profits instead of over rejoicing. Aside from learning how to trade, ensure you figure out your behavior: positive and negative attitudes.

Build confidence

Confidence allows you to act bravely in difficult situations. Building confidence with paper trading requires excess practice. Practice until you can withstand the emotional stress of a real account. Emotional stress is inevitable in live account; taking a step at a time gives you the best confidence when the stress finally comes. Also, a single win can catapult your confidence to a high level; thus, ensure you use a live account when you are ready. Confidence dies when money is involved! This is true; however, you can make it untrue through practice.

Data collection

Data collection is a personal achievement in trading. The sky is your limit if you have access to outstanding data. Elliot Wave theory was devised from personal study and data collection: you will build success if you dedicate your time to recording your findings as you practice with a demo account.

Cons of paper trading

As much as there are benefits of paper trading, there are negative impacts of demo trading that you should avoid.

Limit demo trading correlation to real-life expectation

The demo account is limited, but live accounts receive current and broader market consideration. On this account, the records and trading results are not accurately correct compared to a live account: the same approach on a demo account may give different results on a live account. The differences are due to many conditions and cases: broader live account reach, differences in high correlation, and unequal market volatility index.

Hidden fees and commissions

Again, the normal virtual cost is not the same as real-life expectations. Some little charges affect the exchange rate; even a hidden fee can go as high as a $5 difference. The paper trade price may differ from the real world; ensure you prepare for slippage and commissions: the difference in expected price and the actual price of a trade.

Emotional reality

Emotional stress and challenging situations are active in a real-life trade. If you do not prepare your mind for reality, you may run a loss every time. Ensure you prepare yourself for the live trading before you embark on it. The truth is that emotional reality will continue to be a recessive trait until you taste how it feels with a real account. However, you can prepare ahead with a demo account.

Unrealistic risk-taking measure

Trading comes with risks. However, trading with a demo account does not show the importance of risk in trading. Risk-taking is essential in trade; it determines how you maintain your profits after a trade. Improper risk measurement may jeopardize your trade. The best you could do as a demo trader is to emulate an expert’s analysis and figure out how he manages risk via your demo account. In short, assume risk in your demo practice, and learn how to manage it.

Bottom line

A demo trading account is a fictional account. Still, you can achieve many fortunes – it depends on how you can use the account. Virtually every expert trader today started from a demo account. Thus, paper trading is inevitable for all novice traders – notwithstanding, learning the right approach to demo trading protects you from unimagined circumstances. Apply the techniques and tips listed here in your next demo trading. Remember, all trading comes with a risk – learn how to minimize the risk before you take the risk!

Read more: