Tail Risk In Investments

When it comes to investing, there are a lot of risks that investors need to be aware of. One type of risk that is often overlooked is tail risk. In this article, we will explore what tail risk is, the different types of tail risks, how to measure it, and strategies for reducing exposure to it.

What Is Tail Risk?

Tail risk is the risk of losing a large amount of money due to an unexpected event. This type of risk is often underestimated because it is not easily foreseeable. Some examples of tail events include natural disasters, economic recession, and stock market crashes.

While these events are not easy to predict, there are some factors that can increase the likelihood of a tail event happening. These factors include political instability, high levels of debt, and over-leveraging.

Professional investors define tail risk as the probability of an event happening that is more than three standard deviations away from the mean. This means that there is a less than 1% chance of the event happening.

While the probability of a tail event happening may seem low, the consequences can be severe. This is why it is important for investors to be aware of tail risk and take steps to mitigate it.

Causes Of Tail Risks

There are many different causes of tail risks that investors need to be aware of. Some of the most common types of tail risks include:

1. Natural Disasters

This type of tail risk can occur due to events such as hurricanes, earthquakes, and tsunamis. These events can cause damage to property and infrastructure, as well as disrupt supply chains. For example, the 2011 earthquake and tsunami in Japan caused widespread damage, which led to a decrease in manufacturing output. These kinds of natural disasters can have a significant impact on economies and financial markets.

2. Economic Recession

A tail event that is caused by an economic recession can have a major impact on financial markets. This type of event is often difficult to predict, which makes it all the more dangerous for investors. During an economic recession, businesses may experience decreased demand, which can lead to layoffs and lower profits. This, in turn, can cause a decrease in stock prices and an increase in default rates.

3. Stock Market Crash

A stock market crash is another type of tail event that can have a major impact on the economy. This type of event is often caused by a combination of factors, such as overvaluation, political instability, and economic recession. A stock market crash can lead to a decrease in asset prices, an increase in unemployment, and a decrease in consumer confidence.

4. Political Instability

Political instability is another factor that can increase the likelihood of a tail event happening. This type of event can be caused by a variety of factors, such as war, coups, and elections. Political instability can lead to economic uncertainty, which can impact financial markets.

5. Over-Leveraging

Over-leveraging is another factor that can increase the likelihood of a tail event happening. This occurs when businesses or individuals borrow too much money and are unable to repay their loans. This can lead to defaults, foreclosures, and bankruptcies.

Types Of Tail Risks

The different types of tail risks

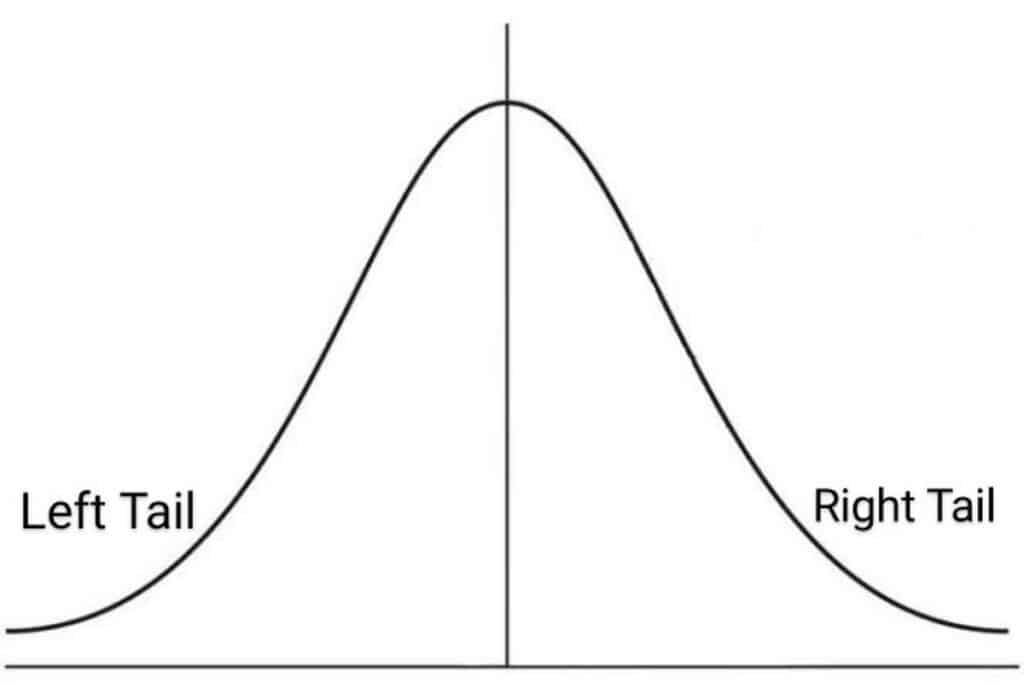

Now that we have discussed some of the causes of tail risks, let’s take a look at the different types of tail risks. There are two main types of tail risks: left-tailed and right-tailed.

1. Left-Tailed

Left-tailed risk is when the likelihood of a negative event happening is greater than the likelihood of a positive event happening. This type of risk is often associated with events such as stock market crashes and economic recessions. A left tailed risk signifies that a company or investor could incur massive losses if the unexpected event occurs. Mind you, tails represent the end portions of bell curves or distribution curves. Therefore, the probability f tails occuring is very small. However, the tail on the far-left side represents the probability of unexpected losses.

2 Right-Tailed

Right-tailed risk is when the likelihood of a positive event happening is greater than the likelihood of a negative event happening. This type of risk is often associated with events such as natural disasters and political instability. A right tailed risk signifies that a company or investor could incur massive gains if the unexpected event occurs. Much like left tailed risks, right tailed risks are also represented by the end portions of bell curves or distribution curves. The tail on the far-right side represents the probability of unexpected gains.

How To Measure Tail Risk

There are many different ways to measure tail risk. Some of the most common methods include:

1. Value at Risk (VaR)

VaR is a statistical measure that is used to quantify the amount of risk that is associated with an investment. VaR can be calculated using a variety of methods, such as historical simulation, Monte Carlo simulation, and extreme value theory. In relation to tail risks, VaR can be used to measure the likelihood of an investment losing a certain percentage of its value over a specified period of time.

2. Expected Shortfall (ES)

ES is another statistical measure that is used to quantify the amount of risk that is associated with an investment. In relation to tail risks, ES can be used to measure the expected loss that an investment will experience if a negative event occurs. This can also estimate the amount of downside risk that an investment is exposed to.

3. Standard Deviation

Standard deviation is a measure of variability that is used to quantify the amount of risk that is associated with an investment. The standard deviation generally measures how far an investment’s return is likely to deviate from the mean or average return. In relation to tail risks, a higher standard deviation signifies that an investment is exposed to a greater amount of risk.

Factors That Increase The Likelihood Of A Tail Event Happening

There are many different factors that can increase the likelihood of a tail event happening. Some of these factors include:

1. Economic Conditions

Economic conditions play a major role in the likelihood of a tail event happening. This is because economic recessions and market crashes often occur when the economy is weak. Additionally, periods of high inflation and high interest rates can also lead to increased levels of volatility in financial markets, which can increase the likelihood of a tail event. Furthermore, geopolitical risks, such as trade wars and political instability, can also lead to increased levels of market volatility.

2. Company-Specific Factors

There are also a number of company-specific factors that can increase the likelihood of a tail event happening. For example, if a company is highly leveraged, it will be more exposed to risk if there is a sudden change in economic conditions. Additionally, companies that are reliant on a small number of customers or suppliers will also be more exposed to risk if those customers or suppliers experience financial difficulties.

3. Market Factors

There are also a number of market factors that can increase the likelihood of a tail event happening. For example, if there is a high level of correlation between different asset classes, this can lead to increased levels of market volatility. Additionally, if there is a large number of participants in the market who are all selling at the same time, this can also lead to a sudden decrease in asset prices.

Strategies For Reducing Exposure To Tail Risk

There are a number of different strategies that investors can use to reduce their exposure to tail risk. Some of these strategies include:

1. Diversification

Diversification is one of the most effective ways to reduce exposure to tail risk. This is because diversification ensures that an investment portfolio is not overly exposed to any one particular asset class or sector. For example, an investor who only invests in stocks will be more exposed to tail risk than an investor who diversifies their portfolio across a number of different asset classes, such as stocks, bonds, and cash.

2. Risk Management

Risk management is another effective way to reduce exposure to tail risk. This involves identifying the risks that are associated with an investment and then implementing strategies to mitigate those risks. For example, an investor may use stop-loss orders to limit their losses if the market unexpectedly turns against them.

3. Hedging

Hedging is another strategy that can be used to reduce exposure to tail risk. This involves taking offsetting positions in different assets in order to mitigate the risk of losses if the market moves against the investor. For example, an investor who is long on stocks may hedge their position by buying put options.

4. Active Management

Active management is another strategy that can be used to reduce exposure to tail risk. This involves actively monitoring an investment portfolio and making changes to it as market conditions change. For example, an investor may sell their stocks and buy bonds if they believe that a market crash is imminent.

5. Options

Options are another tool that can be used to reduce exposure to tail risk. This is because options provide investors with the ability to hedge their positions and limit their losses if the market moves against them.

Examples Of Companies That Have Been Impacted By A Tail Event

There have been a number of companies that have been impacted by a tail event in recent years. Some of these companies include:

1. Lehman Brothers

Lehman Brothers was one of the largest investment banks in the world before it collapsed during the financial crisis of 2008. The collapse of Lehman Brothers led to a number of knock-on effects, such as the failure of other investment banks and the loss of confidence in the global financial system.

2. Bear Stearns

Bear Stearns was another large investment bank that was impacted by the financial crisis of 2008. The company was acquired by JPMorgan Chase in 2008 after it ran into financial difficulties.

3. AIG

AIG is a large insurance company that was also impacted by the financial crisis of 2008. The company received a government bailout of $182 billion to prevent it from collapsing.

Tail Risk and Financial Investing

While there is no sure way to predict or avoid a tail event, there are a number of ways that investors can reduce their exposure to tail risk. By diversifying their portfolios, implementing risk management strategies, and actively monitoring their investments, investors can help protect themselves from the potentially devastating effects of a tail event. When it comes to investing, it pays to be aware of tail risk and to take steps to mitigate it. If you are a retail investor with a portfolio of stocks, you may want to consider buying put options as a form of insurance against a market crash. However, it is important to remember that no investment is ever completely free of risk, and that even the best-laid plans can sometimes go awry.

How Governments Handle Tail Risk

In recent years, there have been a number of high-profile tail events that have had a major impact on the global economy. As a result of these events, many governments have implemented policies and regulations designed to mitigate the risks associated with tail risk. For example, in the wake of the financial crisis of 2008, the U.S. government implemented a number of reforms designed to reduce the likelihood of another financial crisis occurring. These reforms included the Dodd-Frank Wall Street Reform and Consumer Protection Act, which placed new regulations on the financial industry.

The Future Of Tail Risk In The Investment World

The future of tail risk is likely to be shaped by a number of factors, including changes in the global economy and advances in technology. As the world economy continues to become more interconnected, the likelihood of a tail event happening is likely to increase. However, advances in technology and data analysis may help investors better identify and manage tail risk.

Read more: