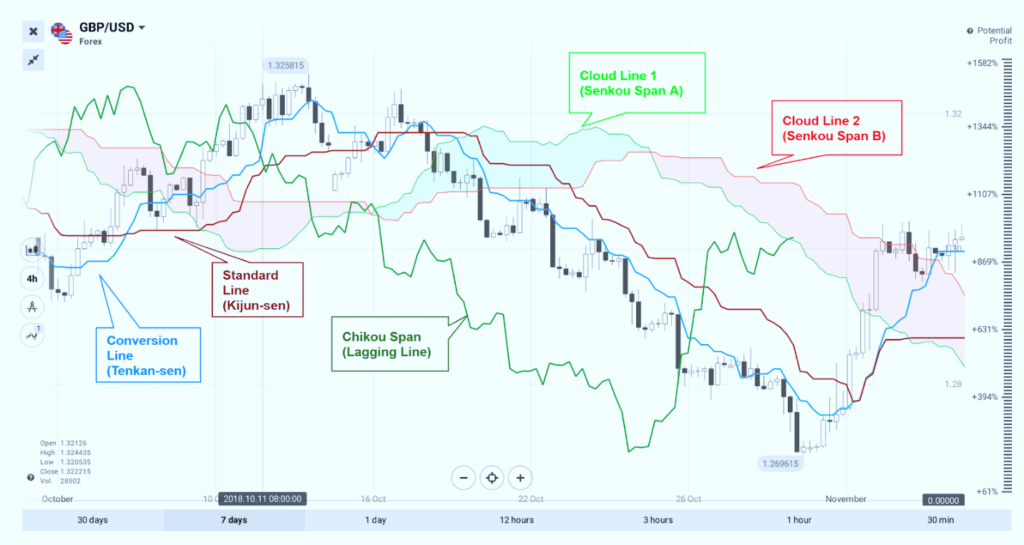

The Ichimoku indicator is an assortment of specialized indicators that show support and resistance levels and the force making a trend of waves and movement. It does this by taking various averages and plotting them on a graph. It likewise utilizes these figures to process a “cloud” that estimates where the price might track down support or resistance later.

The Ichimoku indicator, the equilibrium chart, separates higher trades in the forex market. It is new to the standard however has been ascending in prominence among amateur and experienced investors. Futures and equities are major areas the indicator plays excellently; it is widely applied in these areas. The Ichimoku shows more interest data, giving a more solid price activity.

The application offers numerous tests and joins three indicators into one, permitting an investor to settle on the most grounded choice.

A fundamental comprehension of the parts that make up the Ichimoku should be laid out before an investor can execute really on the indicator. The Ichimoku was made and uncovered in 1968 in a way not at all like most other specialized indicators and applications.

While analysts or mathematicians in the business typically formed technical applications, the indicator was developed by a Tokyo news writer – Goichi Hosoda, and a modest bunch of partners running numerous computations.

Japanese presently utilize this indicator since it offers different tests on the price activity, making higher likelihood trades. Numerous traders are scared by the wealth of lines drawn when the diagram is applied and can handily convert the parts into ordinarily known indicators.

The application comprises four significant parts and offers the investor key experiences in market activity.

First, we’ll show the lines. The lines are a moving normal cross and can be applied as basic interpretations of the 20-and 50-day moving averages.

What is the Ichimoku indicator

Ichimoku is a moving normal-based trend distinguishing proof framework, and because it contains a greater number of data of interest than standard candles, it gives a more clear image of possible price behavior.

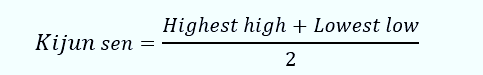

The fundamental contrast between how moving averages are plotted in Ichimoku instead of different techniques is that Ichimoku’s lines are developed involving the half place of the ups and downs instead of the candle’s end price. Ichimoku focuses on the variable of time as an extra component alongside the price activity, like William Delbert Gann’s.

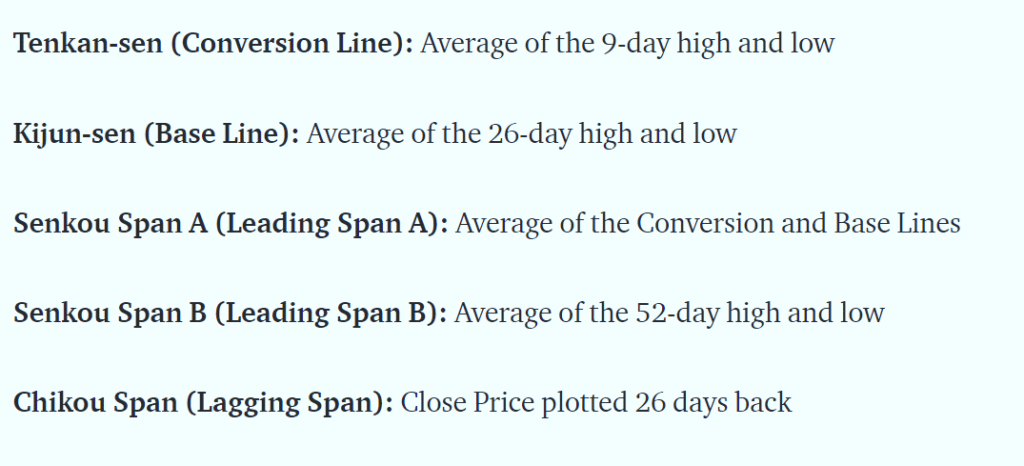

Tenkan-Sen

The Tenkan Sen indicates market trends. It shows the market trending, assuming the red line goes up or down. It flags market ranging, assuming it moves on a level plane.

It is principally utilized as a signature and resistance and support lines. Tenkan Sen is denoted as red –this is the turning line inferred by averaging the most elevated high and the least low for the nine-time frames.

Kijun-Sen

The Kijun Sen goes about as an indicator of future price development. It could keep moving higher on the off chance that the price is higher than the blue line. It could continue to drop, assuming the price is underneath the blue line.

This is an affirmation line, a support/resistance line, applicable in the trailing stop line.

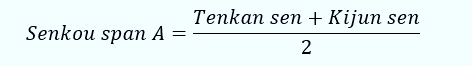

Senkou Span A

The primary concern frames the main resistance level, while the top line is the subsequent resistance level assuming that the price is beneath the Senkou span.

Additionally called leading span 1, this line structures one edge of the Kumo. The top line fills in as the principal support level, while the primary concern fills in as the subsequent support level if the price exceeds the Senkou span.

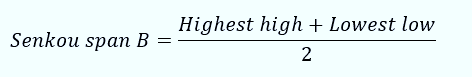

Senkou Span B

Additionally called leading span 2, this line frames the other edge of the Kumo.

Kumo

Kumo gaps Senkou span A and B (the space between them).

The cloud edges recognize current and expected future support and resistance focuses. Given the price differences, the Kumo cloud changes in shape and level. This level shifts as bigger price development’s structure consists of a big cloud, which makes support and resistance more grounded. As more small clouds offer frail support and resistance, prices can and will generally get through such small clouds.

By and large, when Senkou Span A is above Senkou Span B signifies bullish and the other way around signifies bearish. Traders frequently search for Kumo Twists in ongoing clouds, where Senkou Span A and B trade positions signify potential trend inversions.

Also, about the thickness, the strength of the cloud can likewise be learned by its point; upwards for bullish and downwards for negative. Kumo Shadows are any clouds behind the price.

Chikou span

Chikou span = the current shutting price is extended back 26 days on the diagram.

Likewise called the slacking span, it is utilized as a support/resistance help. The purchase signal may be valid if the Chikou Span or the green line crosses the price in the base, up the course. The sell signal may be valid if the green line crosses the price starting from the top.

Is Ichimoku a good indicator?

The indicator might appear to be scary. It is a complicated arrangement, which makes this instrument so strong and flexible. It tends to be used as a trend indicator to distinguish between the trend course and inversion focuses.

It could likewise be utilized to set support and resistance levels for the resource. The Ichimoku indicator is a great base for any procedure, particularly since it very well may be utilized alone as an adequate instrument for specialized trading.

Contrasted with standard candles, the Ichimoku contains more pieces of information, expanding the precision of movements.

The Ichimoku is not the same as a regular moving average. Simple moving averages take shutting prices, add them up, and divide them by the number of prices right there. In a 10-period moving average, the end prices for the last 10-time frames are added and divided by 10 to get the mean.

Notice how the estimations for the Ichimoku are unique. They depend on ups and downs over a period and are separated in two. Hence, Ichimoku averages will be unique concerning conventional moving averages, regardless of whether a similar number of periods are utilized. One indicator isn’t better than another; they give data in various ways.

Is Ichimoku a good strategy?

Ichimoku is among the combo indicators that give you great strategies compared to some indicators because it is not just one component – it contains several pairs in one thing. Ichimoku cloud is an indicator inside a single entity, which is why many strategies are applicable.

Before considering the strategies, let us look at the cloud.

The cloud

The primary line shaping the cloud averages consists of the highs and the lows of the Kijun Sen and the Tenkan Sen; the line is 26 periods forward (to one side). The other line of the cloud shows an average of the highs and the lows on the chart for a 52-period time. Likewise, with the other line of the cloud, this line is additionally dislodged by 26 periods to one side.

These two lines continually associate with one another. Besides, since there is an equivalence, it will keep the two lines close.

The Ichimoku strategies

When bullish price ends at the cloud

A bullish candlestick that ends outside and above the cloud indicates a buy signal. Such a breakout can be viewed as a sign that the price might proceed with its vertical development. A negative candlestick should close outside and underneath the cloud for a substantial sell signal.

When Tenkan-sen and Kijun-sen are underneath the price.

The following condition expects the bullish candlestick to close above both the conversion and standard lines. The conversion line should have previously crossed over the standard line. The negative candlestick closes beneath both the conversion and standard lines for a sell signal. Besides, the conversion line should have previously crossed beneath the standard line.

Chikou Span gets over past price activity

The lagging line ought to have proactively crossed over the past price activity – this wraps things up for expanded probabilities of a legitimate buy signal. In like manner, for a sell signal, the lagging line should have proactively crossed underneath the past price activity.

How accurate is the Ichimoku indicator?

The 5 and 10-day time spans get a lift in the precision of 11%, while the 15, 30, and 60-day periods get increments of around 9%.

These expansions in precision appear to lessen as we move to the 90 days and possibly past, which might address the utility of the signal in the short run.

Even though you can’t address the viability of the signals as the solitary calculation pursuing trading choices, the consideration of the signals inside a prescient examination makes the investigation more successful.

The five plotted lines strategies

When Kumo Breakout:

Bearish signal when price moves out of the lower part of the Kumo Cloud.

Bullish signal when price moves out of the highest point of the Kumo Cloud.

When value crosses Kijun Sen:

Bearish signal when the price goes from above to underneath Kijun Sen (solid when beneath, less active when above Kumo, impartial when inside).

Bullish signal when the price goes from underneath to above Kijun Sen (solid when above, less active when beneath Kumo, impartial when inside).

When Tenkan/Kijun Cross:

Bearish signal when Tenkan goes from above Kijun to underneath (solid when beneath, less active when above Kumo Cloud, impartial when inside).

Bullish signal when Tenkan goes from underneath Kijun to above (solid when above, less active when beneath Kumo Cloud, impartial when inside).

When Senkou Span crosses

Bearish signal when Senkou Span A maneuvers from above to underneath Senkou Span B (weak when above Kumo, impartial when inside, solid when underneath).

Bullish signal when Senkou Span A maneuvers from underneath to above Senkou Span B (weak when beneath Kumo, impartial when inside, solid when above).

When Chikou Span Crosses Price:

If Chikou Span changes from above to underneath price indicates a bearish signal (frail when above Kumo, impartial when inside, solid when beneath).

If Chikou Span changes from underneath to above price indicates a bullish signal (powerless when beneath Kumo, impartial when inside, solid when above).

The subsequent stage in consolidating this examination came through encoding the signals. There were two choices:

- Use picture handling to recognize the available signals.

- Physically encode the lines and find the intersection focuses by recognizing when lines changed from being more noteworthy to short of each other.

The next section gives a pictorial illustration.

How do you read the Ichimoku indicator?

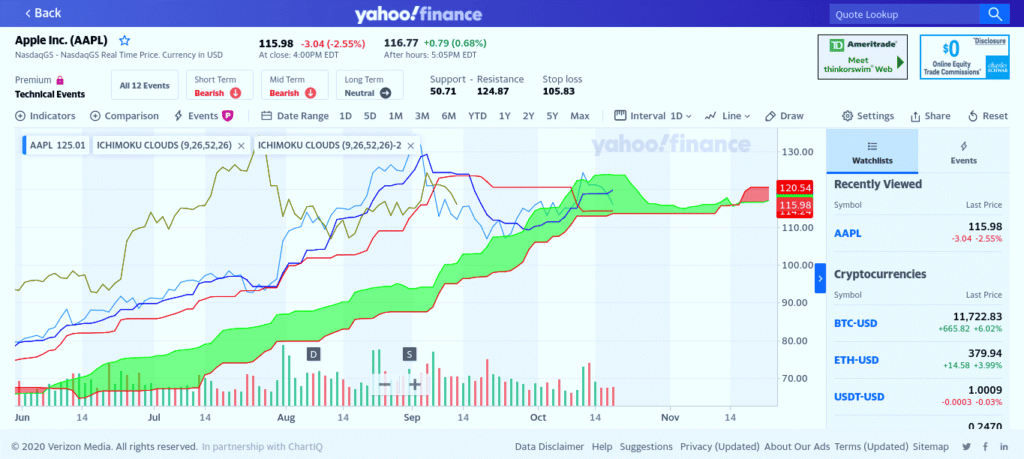

The outline is currently painted with a progression of various coded pattern lines.

Likewise, you’ll see that the space between two key pattern lines is hued in, with certain areas being green and some red. Every one of these lines and color regions gives important data. Although many people allude to the whole indicator as the Ichimoku, a single marker piece is the “cloud.”

The Ichimoku is the colored region found between the pattern lines for leading range A and leading range B. The general indicator, including the Ichimoku and all pattern lines, is plotted on the diagram – this is known as the Ichimoku Kinko Hyo. Albeit this might look too perplexing even to consider grasping, it’s very straightforward utilizing the image above:

The Conversion Line (Kenkan Sen)

The faint blue line above is the conversion line: a plotted pattern line that sits between the highs and lows over the past nine tradings. The number of sessions can be changed in the settings by changing the conversion line period.

The conversion line is a vital degree of help when price trade is above it and resistance when prices trade beneath it.

A bullish breakout occurs assuming a stock traded underneath the conversion line breaks above it, and traders see the move as a buy signal. If a stock trading over the conversion line breaks underneath it, the move is considered a bearish breakout.

The Base Line (Kijun Sen)

The red line on the diagram above trails the conversion line as the more slow-moving normally in the Ichimoku Cloud. It is the middle point between a stock’s high and low prices over 26 tradings.

The standard, or following moving average, is often utilized as the following stop-loss when traders ride an uptrend toward gains. Should prices tumble to this point, positions are sold because of a paranoid fear of a bearish breakout.

Leading Span A (Senkou Span A)

Leading Span A is one more moving average, showing the trade action over the 52 trading sessions. On the chart above, leading Span A will show up in a radiant green tone at the highest point of the colored Ichimoku Cloud during bullish moves and at the base during bearish moves.

While Leading Span A transcends Leading Span B, an uptrend is affirmed. For this situation, the shade between the two lines will be hued green, allowing traders to recognize the uptrend rapidly.

On the other hand, while leading range A maneuvers underneath leading range B, a downtrend is affirmed. For this situation, the shade between the two lines is hued red.

Leading Span B (Senkou Span B)

Leading Span B is the dark red pattern line that frames the other edge of the colored Ichimoku Cloud. While leading range B is above leading range A, a downtrend is affirmed, and the cloud is colored red. While leading range B is underneath leading range A, an uptrend is affirmed, and the Ichimoku Cloud is colored green.

The Cloud

The key areas of support and resistance are leading range A and leading range B; they make a cloud and assist with deciding the pattern course when you check the averages. Additionally, the Ichimoku Cloud above or underneath crosses can be strong trading signals. They are areas of strength at the point when the conversion line crosses over the baseline, and the price activity happens over the Ichimoku Cloud.

Conversely, the signal is exceptionally bullish when the conversion line crosses beneath the baseline, and the price activity happens underneath the Ichimoku Cloud.

The Lagging Span (Chikou Span)

The lagging span can be found by searching for the brown line on the chart. You’ll see that the line is removed 26 periods in the past naturally, which can be changed by changing the lagging span period in the Ichimoku Cloud settings. This pattern line is utilized to assist investors with understanding the connection between the latest and past patterns to settle on savvier instructed choices. Numerous traders accept that while the lagging span crosses current prices, it’s a trend signal. At last, the Ichimoku indicator can give different sell signals.

Read more: